Comprehensive financial analysis is a must for business coaches.

Too many business owners think that to get ahead financially they need to sell more and do more. However, this is incorrect most of the time.

Financial analysis must be a fundamental part of your business coaching methodology.

Why? Because doing more (pouring more into the top of the bucket) will not increase personal financial wealth if there are too many holes in the bottom of the bucket.

It can be very frustrating for business coaches and advisors when clients only want to focus on hitting a home run – meaning make more sales. Below is a great way to illustrate how it is more effective to fix the financial holes in the business before pouring more sales into the top of the bucket.

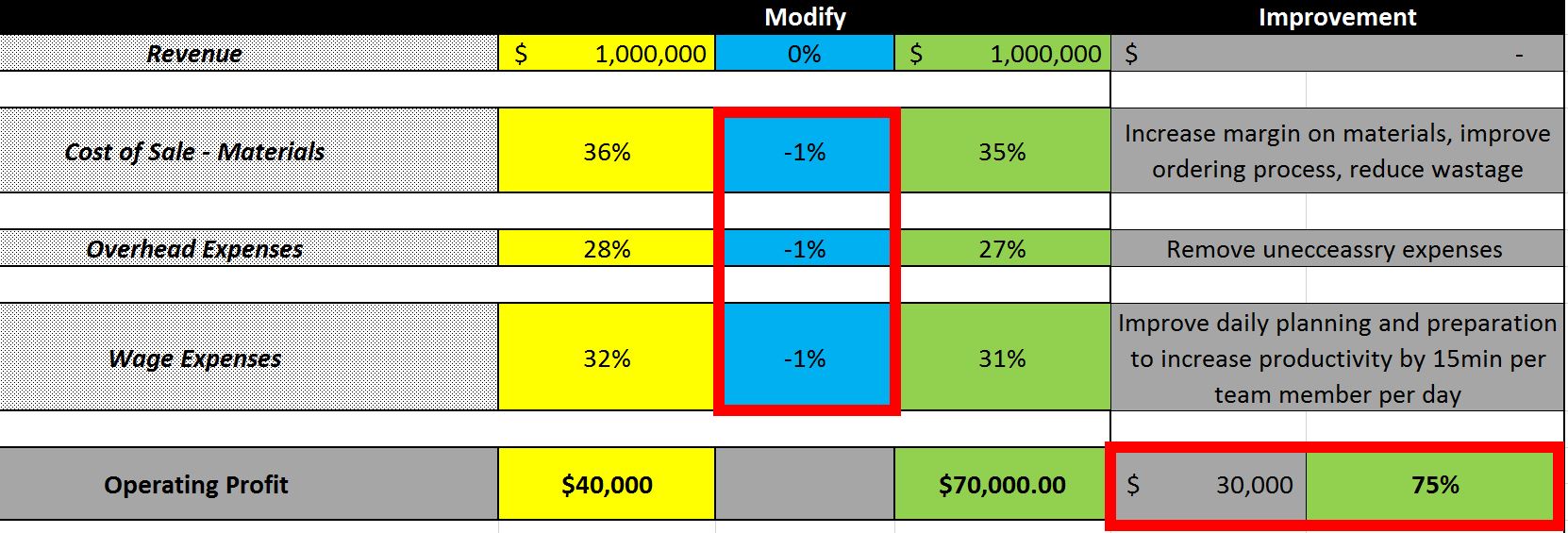

Here is a very simple financial analysis philosophy how to increase profitability - focus on the ‘power of the tiny 1% improvements’:

- Cost of Sale as a % of Revenue - FOCUS on increasing margins on stock, tightening up the ordering process, and reducing wastage.

- Overhead Expenses as a % of Revenue - FOCUS on eliminating expenses that do not add value to the customer or the business.

- Wage Expenses as a % of Revenue - FOCUS on improving daily/weekly planning and preparation to eliminate unproductive minutes to increase individual productivity by 15 minutes per day.

RESULT - As per table below a reduction of 3% results in an increase in operating profit by 75% ($30,000)

Detailed Financial Analysis to show increase in profitability

Beware being stuck in the 'comfort zone' - technician mindset thinking only need to sell more to get ahead

When you present the above financial analysis to business owners all agree it makes sense, however MOST state "yes that's great but I don't have time because I am flat out trying to keep everything running".

This statement is the classic 'technician mindset syndrome' talking where the business owner does not want to get out of their comfort zone to sit down to work ‘ON’ the business to analyse the performance. The business owner is very comfortable working ‘IN’ the business, on the tools running around putting out fires.

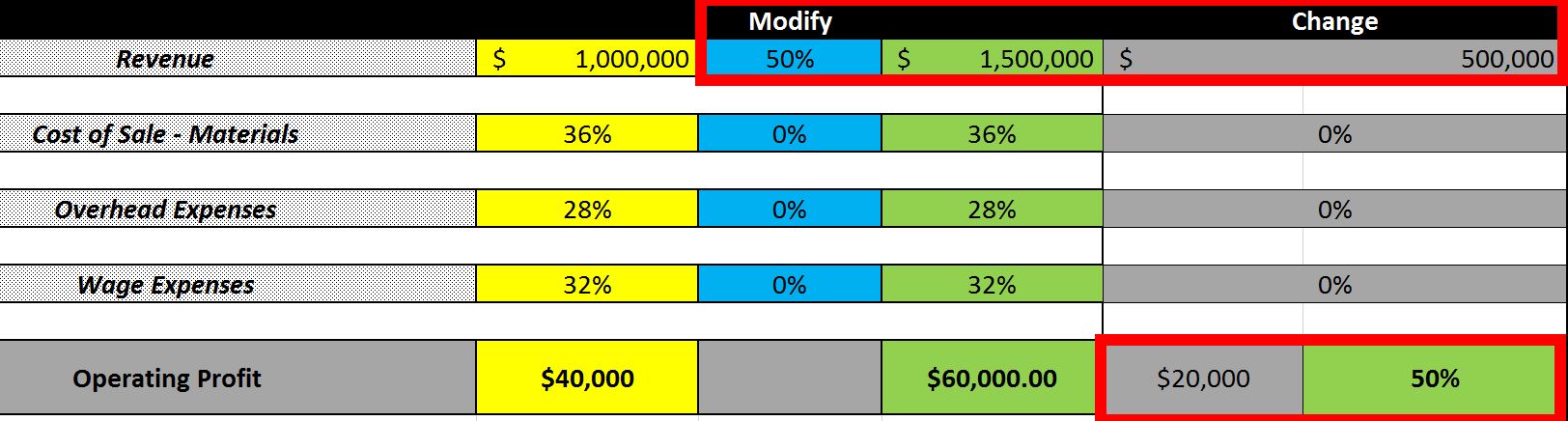

Here is a classic 'technician mindset' strategy how to increase profitability:

- Increase sales - Ramp up marketing.

RESULT - As per table below investing a huge amount of blood, sweat & tears to increase revenue by 50% results in an increase in operating profit by 50% ($20,000)

Sales Analysis to show increase in profitability

Moral of the story

Taking the time to fill the holes in the 'bottom of the bucket' resulted in an extra $10,000 ($30,000 increase against $20,000 increase) operating profit!

For the business owner rather than investing huge amounts of money, blood, sweat & tears in marketing, recruiting more team members, doing more jobs, and doing more admin, just STOP!

Your priority as a coach and advisor is to ensure your clients take the time to review and understand their financial analysis numbers/scorecard to be able to:

- Identify where the holes are in the 'bottom of the bucket (business)'.

- Determine what process needs to be implemented/tightened to fix these holes.

- Assign accountability to get it fixed – who & by when.

Financial Analysis Intelligence

TheCUBE business coaching software platform is designed to provide both the business and the coach with a clear view of the financial numbers. 100% full financial analysis transparency for all key stakeholders is required to drive intelligent decision making, and to remove ‘technician mindset’ guessing.

Don't be fearful of the numbers - get excited by the numbers!

Cheers

Matthew Jones

TheCUBE Founder & CEO

TheCUBE is a powerful business coaching platform allowing coaches to deliver greater results and life changing value to more clients with less effort.